For procurement leaders, contract manufacturers, and brand owners launching private-label supplements, the supplement pouch is not a cosmetic choice — it is a technical control point. It affects product stability, regulatory exposure, and total cost of ownership.

In this blog, Meishi, a leading pharmaceutical packaging manufacturer, is delighted to share cautions with supplement pouches and packaging with intent buyers who must determine whether a prospective pouch solution will perform on their line, preserve actives, and scale without creating downstream liability.

Translate Product Goals into Measurable Acceptance Criteria

Start by defining outcomes in technical terms, not aspirations.

- Target shelf life (e.g., 12 months ambient).

- Active retention targets (e.g., ≥90% vitamin C at 6 months).

- Acceptable headspace O₂ and moisture ingress.

- Mechanical robustness for your distribution (drop, stack).

Then convert these into test metrics you will require: OTR/MVTR targets, seal strength (N/15 mm), and accelerated stability thresholds. These form the contractual baseline for supplier evaluation.

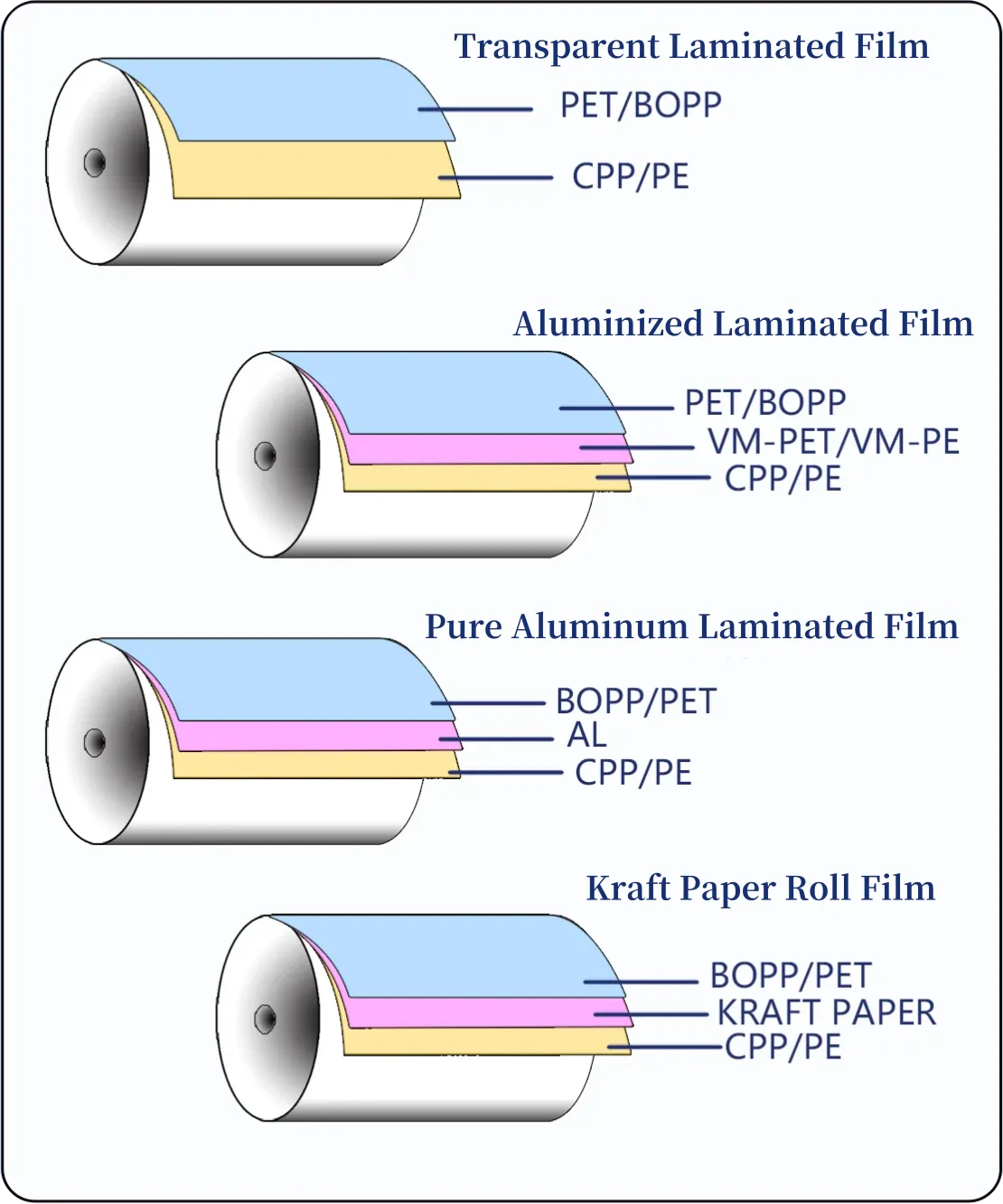

Choose Film Structures Based on Formulation Chemistry

Different formulas need different laminates.

- Hygroscopic powders: low MVTR films; consider desiccants.

- Oil-based softgels: chemical-compatible sealants to avoid migration.

- Gummies/chewables: anti-stick inner layers and low water activity transfer.

Common laminate families:

- PET/AL/PE: high barrier, long ambient life.

- PET/EVOH/PE: oxygen barrier + partial clarity.

- PE/PE mono-material: recyclable, but shorter shelf life.

Ask suppliers to justify structure choice against your formula — avoid one-size-fits-all answers.

Specify Functional Features That Actually Matter

Functional options must support production and consumer use.

- Zippers: require cycle-life testing and residual leak data.

- Spouts: specify diameter, material (PP for hot processes), and weld geometry.

- Child-resistant / tamper-evident: define test requirements up front.

Include functional test requirements in your RFQ so vendors respond with validated data, not marketing claims.

Require Layer-level Compliance — Generic Docs Aren’t Enough

Demand documentary proof for every component.

- Layer-specific Declarations of Compliance (DoC) and Certificates of Analysis (CoA).

- Migration testing (overall & specific) against relevant food simulants.

- Organoleptic tests after accelerated aging for odor/taste transfer.

Contractually require that the certificates correspond to the actual production lot — stock or generic certificates are not acceptable for audit readiness.

Pilot Runs on Your Actual Filler Are Mandatory

Bench tests ≠ production readiness.

Typical pilot issues:

- Static or bridging is causing inconsistent fills.

- Inadequate seal cooling time → delamination.

- Spout misalignment at speed → leaks.

- Particulate prevents full seals.

Require a witnessed pilot with agreed acceptance tests (seal peel, burst, leak, headspace O₂) and capture run rate, waste %, and downtime impact. Use pilot results to finalize specs.

Evaluate the Total Cost of Ownership (TCO), Not the Unit Price

The lowest unit price often hides downstream costs.

Include these factors in TCO:

- Expected scrap & returns.

- Line downtime and requalification costs.

- Freight impact of material weight (and MOQ implications).

- Risk exposure: warranty, recalls, brand damage.

Vendors that collaborate on TCO analysis are preferable to those pushing the lowest upfront price.

Select Suppliers as Technical Partners

Qualities to look for:

- Layer-level technical dossiers and proof of similar projects.

- Demonstrated pilot capability and inline coding/printing controls.

- Transparent change management and lot traceability.

- Willingness to share corrective-action history and references.

Speed without verification is a major red flag.

Make Contract Terms Enforce Performance

Translate acceptance criteria into contract language:

- Test methods, sample sizes, and acceptable failure rates.

- Protocols for retest and nonconformance handling.

- Prohibition of unapproved material substitutions.

- Lot traceability requirements go back to raw suppliers.

- Liability tied to agreed shelf-life KPIs.

Contracts should reduce ambiguity and transfer measurable risk to the supplier.

Conclusion — Treat the Supplement Pouch as a Systems Decision

A supplement pouch is a product-quality control, not an ornament. Define measurable preservation and functional targets, validate on your line, and demand layer-level compliance. Choose suppliers for technical competence and enforce performance through a contract. Do this, and the pouch becomes a controlled lever in your quality system — preserving potency, lowering risk, and enabling reliable scale.

Acerca de Meishida

Meishida is a leading pharmaceutical packaging manufacturer specializing in wholesale supplement pouches for health and nutrition brands. Backed by robust manufacturing capabilities, we convert brand concepts into well-executed packaging with precise structures, clean finishes, and market-ready performance.

Our team supports custom supplement pouch solutions, from material selection to functional design, while remaining open to new formats and innovations. Production is carried out in a regulated facility that follows internationally recognized safety and compliance standards, ensuring consistent quality and dependable supply for global partners.

FAQ — Common Procurement Mistakes Experienced Buyers Learn to Avoid

(Each question pairs the mistake with its practical consequence.)

Q1: Is choosing a pouch based on appearance a common error?

Yes. Visual choices often under-spec barrier performance, accelerating oxidation or moisture ingress, and causing premature failures.

Q2: What happens if we skip real-line pilot runs?

You risk production failures (seal defects, spout leaks, particulate issues) that cause downtime, scrap, and delayed launches.

Q3: Can accepting generic DoCs be risky?

Absolutely. Generic DoCs don’t verify that the specific film lot used meets migration or odor criteria — increasing regulatory and recall risk.

Q4: Why is ignoring traceability dangerous?

Without lot-level traceability for films and spouts, root-cause analysis and targeted recalls are impossible, amplifying cost and brand damage.

Q5: Is lowest-price procurement a false economy?

Often. The lowest unit price can mask higher TCO from increased returns, line issues, and reputational loss. Evaluate total cost, not just sticker price.